【ARCFE Blog】 RURAL MIGHT SEE A BACKLOG BEFORE HUA?

- ARCFE U.S.

- May 22, 2024

- 5 min read

In this article:

Rural might see a backlog before HUA

New visa allocation process: will it help with reducing backlog?

Investment risk & security

On May 20th, 2024, the Invest In the USA (IIUSA) organization hosted its annual industry conference in Atlanta. The event was attended by a diverse group of industry professionals, including attorneys, economists, regional center representatives, and notably, Michael Hanley from the U.S. Department of State (DOS), who shared significant and valuable data insights.

About Michael Hanley

Michael Hanley joined the DOS as a Data Scientist in June 2022. Within the Bureau of Consular Affairs, he specializes in overseeing immigrant visa numerical controls, reporting visa statistics, modernizing visa data analytics methodologies, and briefing congressional and industry stakeholders on issues pertaining to numerical controls.

PhD in Political Science and Government at Emory University

Master in Educational Policy and Leadership at Marquette University

Bachelor in Political Science at Princeton University

Experienced in data analysis and research including Machine Learning, Linear Regression, Quantitative Research, et cetera.

Rural Might See A Backlog Before High Unemployment Area (HUA)

As of May 19th, there are a total of 17 USCIS adjustments, comprising 14 Rural and 3 High-Unemployment Area (HUA) cases. This data aligns with the expectation that, due to priority processing for Rural applications, a higher number of Rural applicants have entered the queue compared to HUA applicants. DOS determines the backlog and priority dates based on the number of applicants in the queue. Consequently, it is possible that Rural projects may experience a backlog before HUA projects.

《 Table 1 》

《 Example 》

Using the data provided as an example, there are currently 45 Indian cases queued at the National Visa Center (NVC) for India. Based on the 14:3 Rural to HUA ratio provided by the DOS, approximately 37 Rural applicants and 8 HUA applicants are in the queue.

《 Table 2 》

《 Table 3 》

Continuing with the previous example, assuming each family (case) requires an average of two visas, a total of 74 visas will be allocated for Rural applicants and 16 visas for HUA applicants. Consequently, the total visa demand for India reserved categories amounts to 90 visas.

Rural:

74 (needed) / 356 (available) = 21% (used)

HUA:

16 (needed) / 178 (available) = 9% (used)

Combining all the information above, it is evident that the Rural category is depleting the available visas at a significantly faster rate. Consequently, it is reasonable to predict that the Rural category may experience a backlog sooner than the HUA category. However, looking at the adjudication data, investors from countries prone to backlogs, such as Mainland China and India, do not need to be concerned about retrogression for reserved categories at this time. Specifically for Mainland China, which has the highest volume of applications, the earliest potential backlog for reserved categories is anticipated in FY 2025.

Additionally, investors under the EB-5 Reform & Integrity Act of 2022 (EB-5 RIA 2022) might be eligible for multiple visa categories, which could potentially help with reducing the backlog.

New EB-5 Visa Allocation Process

Recently, the National Visa Center (NVC) has begun processing the initial group of I-526E investors following the implementation of the new policy. Previously, for applicants residing outside the U.S., the NVC would ascertain the visa category to be issued. However, under the new procedure, the approval letter for I-526E investors now includes two categories simultaneously. To illustrate, let's consider the Approval Notice for an ARCFE investor under the EB-5 RIA 2022.

As indicated in the Approval Notice, RU-6 denotes the visa category for projects affiliated with regional centers within the unreserved visa category, while RH-6 designates the visa category for regional center projects situated in HUA within the reserved visa category.

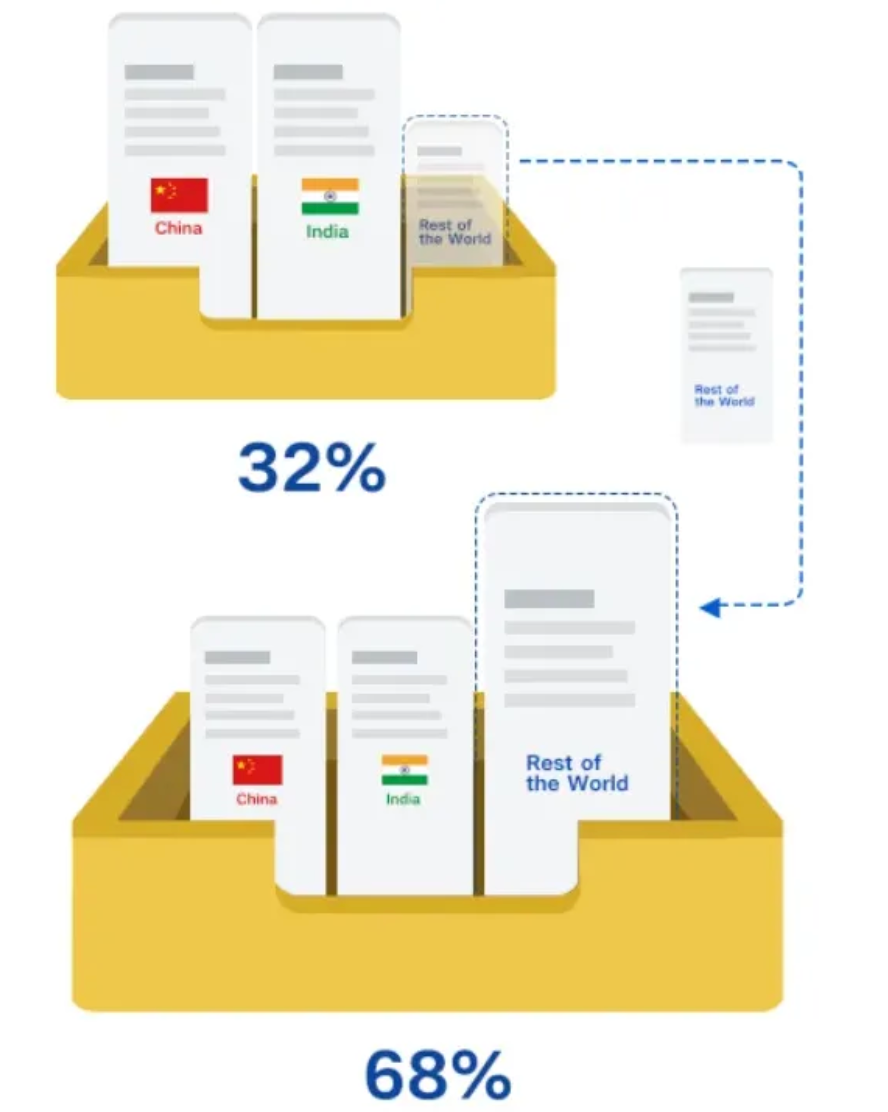

Investors participating in the EB-5 RIA 2022 program, upon the approval of their I-526E petitions, possess the option to transition to pursuing unreserved visas for their green cards. Presently, only investors from Mainland China and India are subject to visa backlog under the unreserved EB-5 category, while investors from other countries (ROW) are not constrained to solely rely on reserved visa categories. They are not obliged to await the exhaustion of the 32% reserved visa quota. Instead, they can directly pursue the unreserved visa category, which offers a larger overall quota.

《 June 2024 Visa Bulletin - Chart A 》

Under the EB-5 RIA 2022, any unused visa numbers within each reserved category (total reserved - 32%) are carried forward into the same category for the subsequent year. Beyond the second year, any remaining unused visa numbers are transferred into the general pool (unreserved - 68%).

Applicants from countries not experiencing backlogs, such as Mainland China or India, may find a stronger incentive to opt directly for the general pool (unreserved - 68%) due to its higher visa availability. In such a scenario, the quantity of unused reserved visas for "other countries" could be substantial. If these visas are then carried over into the following year, the total visa allocation quotas would increase (# of visas available for the fiscal year + # of unused visa carryovers), resulting in a greater number of visas available for the reserved categories of Mainland China and India. This could potentially mitigate or delay the backlog issue facing the reserved categories for Mainland China and India.

Investment Risk & Security

While all investments carry inherent risks, EB-5 investors must thoroughly understand the level of risk they are assuming. Investing in a project with a higher safety net is advantageous as it significantly reduces the potential for financial loss and increases the likelihood of meeting the program's requirements for job creation and capital preservation. A well-secured investment enhances the chances of successfully obtaining permanent residency. Therefore, careful evaluation of the project's risk factors and choosing those with robust safeguards is crucial for EB-5 investors.

Investors should consider projects where EB-5 capital acts as the senior loan secured with a mortgage because this structure ensures their investment has the highest repayment priority, reducing financial risk. A mortgage-backed senior loan provides tangible collateral, further safeguarding the investor's funds. This arrangement also increases the likelihood of project completion and successful job creation, both critical for fulfilling EB-5 visa requirements. Therefore, such investments offer a balanced approach to achieving permanent residency while protecting the investor's capital.

ARCFE Investors and Projects Continue Receiving Approvals

Under the EB-5 RIA 2022, ARCFE investors and projects have achieved many successes. Our investors are continuing to receive I-526E approvals from USCIS, with the fastest case being within less than 1 month from the project's I-956F approval.

ARCFE post-RIA HUA projects, such as Group 12 Jackson, Group 13 38th Ave/Thomson, Group 14 Davis/Union and Group 15 Dutch Kills have been approved by the USCIS. Specifically for Group 15 I-956F approval came within only 7 months of filing, showing that processing time for an HUA project is not that much different from a rural project.

HUA Project Group 19 With Similar Structure As Group 15

Opens For Investment

Group 19 Brooklyn Gowanus is a residential development project located in the emerging and vibrant Gowanus neighborhood of Brooklyn (New York City). With a total construction area of 135,000 sqft, this 14-story mixed-use building will have 130 rental units, along with ~9,000 sqft of ground-floor retail space and ~6,000 sqft of art space.

The EB-5 capital in Group 19 will go into the project in the form of a senior loan secured with mortgage, offering the highest safety measure for investors. The project is expected to create sufficient jobs for all investors and is looking to repay within 3.5 years. We also offer flexible investment plans that would allow investors to file their petition after an initial investment of $200,000 (+fees) and be fully funded within 1 year.

Disclaimer: This article presents analyses and opinions based on available information and should not be construed as legal advice. Investors are encouraged to seek guidance from a qualified attorney regarding legal matters pertaining to their immigration process.